In the realm of business, understanding workers compensation insurance California requirements is crucial. This essential coverage ensures protection for both employers and employees in the Golden State, with legal obligations and benefits intertwined. Dive into the specifics of what it takes to comply with the necessary regulations and secure adequate insurance.

Exploring the ins and outs of workers compensation insurance in California reveals a landscape of legal mandates, coverage nuances, and practical considerations that shape the insurance process.

Workers Compensation Insurance Overview

Workers compensation insurance in California is a crucial form of protection for both employers and employees. It provides coverage for medical expenses, lost wages, and rehabilitation costs for employees who are injured or become ill while on the job.

Purpose of Workers Compensation Insurance

- Ensures that employees receive necessary medical treatment and compensation for lost wages in case of work-related injuries or illnesses.

- Protects employers from potential lawsuits by providing a no-fault system where employees cannot sue their employer for workplace injuries.

- Promotes a safer work environment by encouraging employers to prioritize employee safety and risk management.

Key Benefits for Employers

- Legal Protection: Compliance with state laws and regulations helps avoid penalties and fines.

- Financial Security: Coverage for medical expenses and lost wages can prevent financial strain on the business.

- Employee Morale: Providing workers compensation insurance shows employees that their well-being is a priority.

Legal Requirements in California

- All employers in California, regardless of the number of employees, are required to have workers compensation insurance.

- Failure to provide workers compensation insurance can result in penalties, fines, and legal consequences for the employer.

- Employers must purchase workers compensation insurance from a licensed insurance carrier or through the State Compensation Insurance Fund.

California Workers Compensation Insurance Requirements

In California, employers are required to obtain workers’ compensation insurance to provide benefits to employees who suffer work-related injuries or illnesses. This insurance coverage helps ensure that employees receive medical care and financial support if they are injured on the job.

Specific Requirements for Employers

- Employers in California must have workers’ compensation insurance coverage for all employees, including full-time, part-time, seasonal, and temporary workers.

- Failure to provide workers’ compensation insurance can result in penalties, fines, and legal consequences for employers.

- Employers are required to obtain workers’ compensation insurance from a licensed insurance company or through the State Compensation Insurance Fund (SCIF).

Penalties for Non-Compliance

- Employers who fail to carry workers’ compensation insurance in California may face penalties of up to $100,000, criminal charges, and potential civil lawsuits from injured employees.

- Non-compliance with workers’ compensation insurance requirements can also result in the suspension of business operations and the revocation of business licenses.

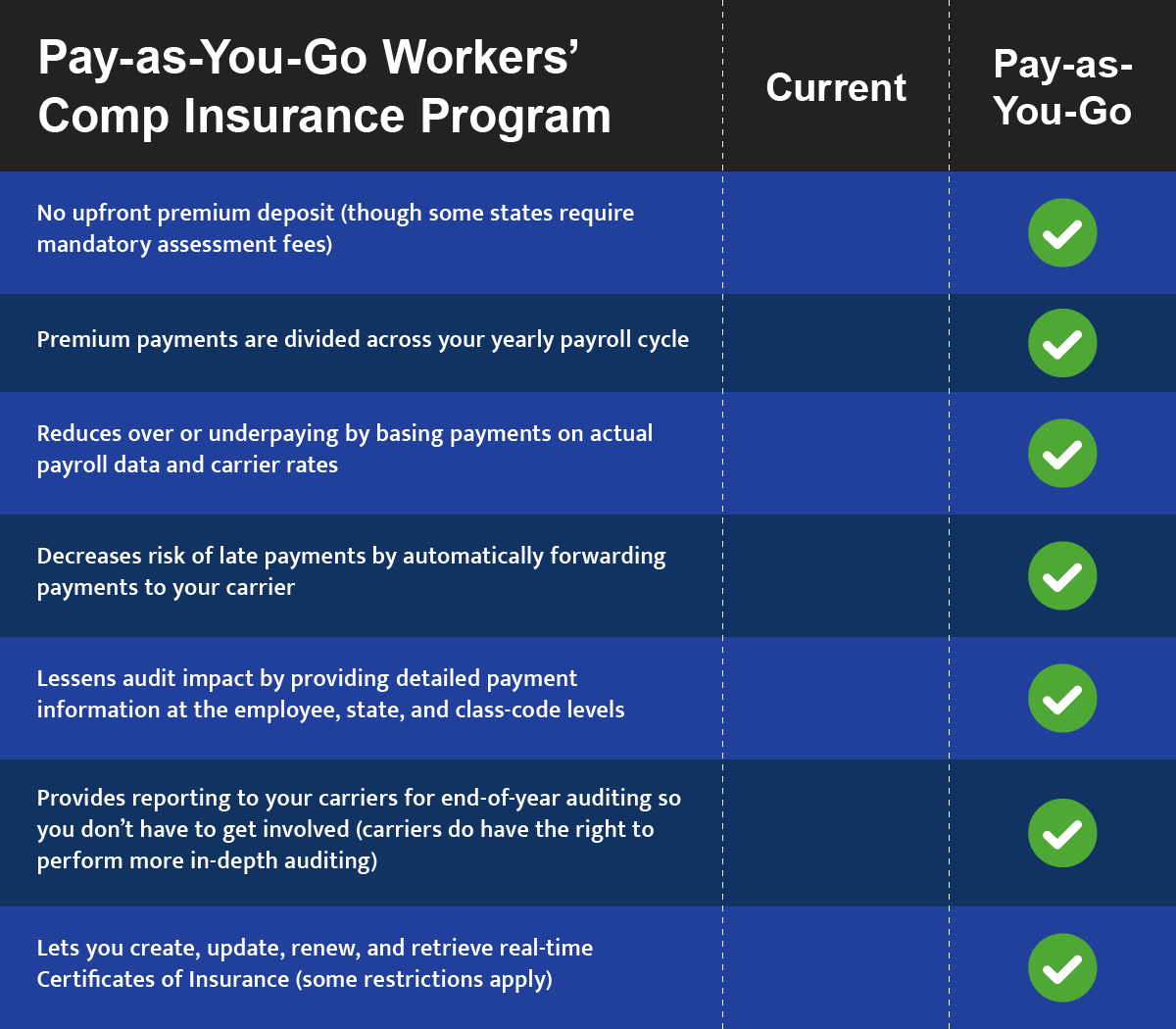

Acquiring Workers Compensation Insurance

- The cost of workers’ compensation insurance in California varies depending on factors such as the type of business, the number of employees, and the industry’s risk level.

- Employers can shop around for insurance quotes from different providers to find the best coverage at competitive rates.

- It is important for employers to accurately report employee wages and job classifications to ensure they have adequate coverage and comply with state regulations.

Coverage Details

When it comes to workers’ compensation insurance in California, it’s crucial to understand the types of injuries and illnesses covered, as well as the limitations of coverage provided. Let’s delve into the specifics.

Types of Injuries and Illnesses Covered, Workers compensation insurance california requirements

- Workers’ compensation insurance in California typically covers injuries and illnesses that occur in the workplace or are directly related to work activities.

- This includes injuries from accidents, such as slips and falls, as well as repetitive stress injuries like carpal tunnel syndrome.

- Coverage may also extend to occupational diseases developed as a result of workplace conditions, such as respiratory issues from exposure to harmful substances.

Limitations of Coverage

- While workers’ compensation insurance provides coverage for work-related injuries and illnesses, there are limitations to the extent of this coverage.

- Coverage may be denied if the injury was self-inflicted, occurred while the employee was under the influence of drugs or alcohol, or was the result of a violation of company policies.

- Additionally, coverage may not apply if the injury occurred outside of work hours or off company premises.

Scenarios Where Workers’ Compensation Insurance Applies

- If a construction worker falls from scaffolding and sustains injuries while on the job, workers’ compensation insurance would likely apply to cover medical expenses and lost wages.

- In the case of a retail employee developing carpal tunnel syndrome from repetitive scanning at the checkout counter, workers’ compensation insurance could provide coverage for treatment and rehabilitation.

- If a factory worker is exposed to toxic chemicals and develops a respiratory illness as a result, workers’ compensation insurance would likely cover medical expenses and disability benefits.

Filing a Claim: Workers Compensation Insurance California Requirements

When it comes to filing a workers’ compensation insurance claim in California, there are specific steps and requirements that must be followed to ensure a smooth process and timely compensation for work-related injuries or illnesses.

Steps for Filing a Claim

- Gather all necessary information about the injury or illness, including the date, time, and location it occurred.

- Notify your employer about the injury or illness as soon as possible to initiate the claims process.

- Complete the DWC-1 claim form provided by your employer or workers’ compensation insurance carrier.

- Submit the completed form to your employer and the claims administrator within the specified timeframe.

- Follow any additional instructions or requests for information from the claims administrator to process your claim efficiently.

Documentation Required

When filing a workers’ compensation insurance claim in California, certain documentation is crucial to support your claim and ensure prompt processing. Required documentation may include:

- Medical records related to the injury or illness

- Witness statements, if applicable

- Incident reports filed with your employer

- Proof of lost wages or income due to the injury

- Any other relevant documentation requested by the claims administrator

Role of Medical Providers

Medical providers play a vital role in the workers’ compensation insurance claim process by:

- Diagnosing and treating the work-related injury or illness

- Documenting the medical treatment provided and progress of the injured worker

- Providing medical reports and records to support the workers’ compensation claim

- Communicating with the claims administrator regarding the injured worker’s medical status and treatment plan

Conclusion

Delving into the realm of workers compensation insurance California requirements unveils a complex yet vital aspect of business operations. From legal obligations to coverage details, understanding these essential elements is key to navigating the intricacies of workplace insurance with clarity and confidence.