Personal insurance meaning encompasses the protection it offers individuals against various risks, providing financial security and peace of mind. Let’s delve into the world of personal insurance to understand its significance in safeguarding our future.

Definition of Personal Insurance

Personal insurance refers to a type of insurance that provides coverage for individuals and their families against financial losses resulting from various risks and uncertainties. The primary purpose of personal insurance is to offer protection and financial security in times of need.

Types of Risks Covered by Personal Insurance

- Health Insurance: Covers medical expenses and treatments for illnesses or injuries.

- Life Insurance: Provides financial support to beneficiaries in case of the insured person’s death.

- Property Insurance: Protects against damage or loss of personal property due to events like theft, fire, or natural disasters.

- Disability Insurance: Offers income replacement if the insured becomes disabled and is unable to work.

- Liability Insurance: Covers legal expenses and damages in case the insured is held liable for injury or property damage to others.

Importance of Personal Insurance in Financial Planning

Personal insurance plays a crucial role in financial planning by mitigating risks and uncertainties that could lead to significant financial burdens. It provides a safety net for individuals and families, ensuring that they are protected against unforeseen events that could impact their financial well-being. By having the right personal insurance coverage in place, individuals can safeguard their assets, secure their loved ones’ future, and achieve peace of mind knowing that they are financially protected.

Types of Personal Insurance

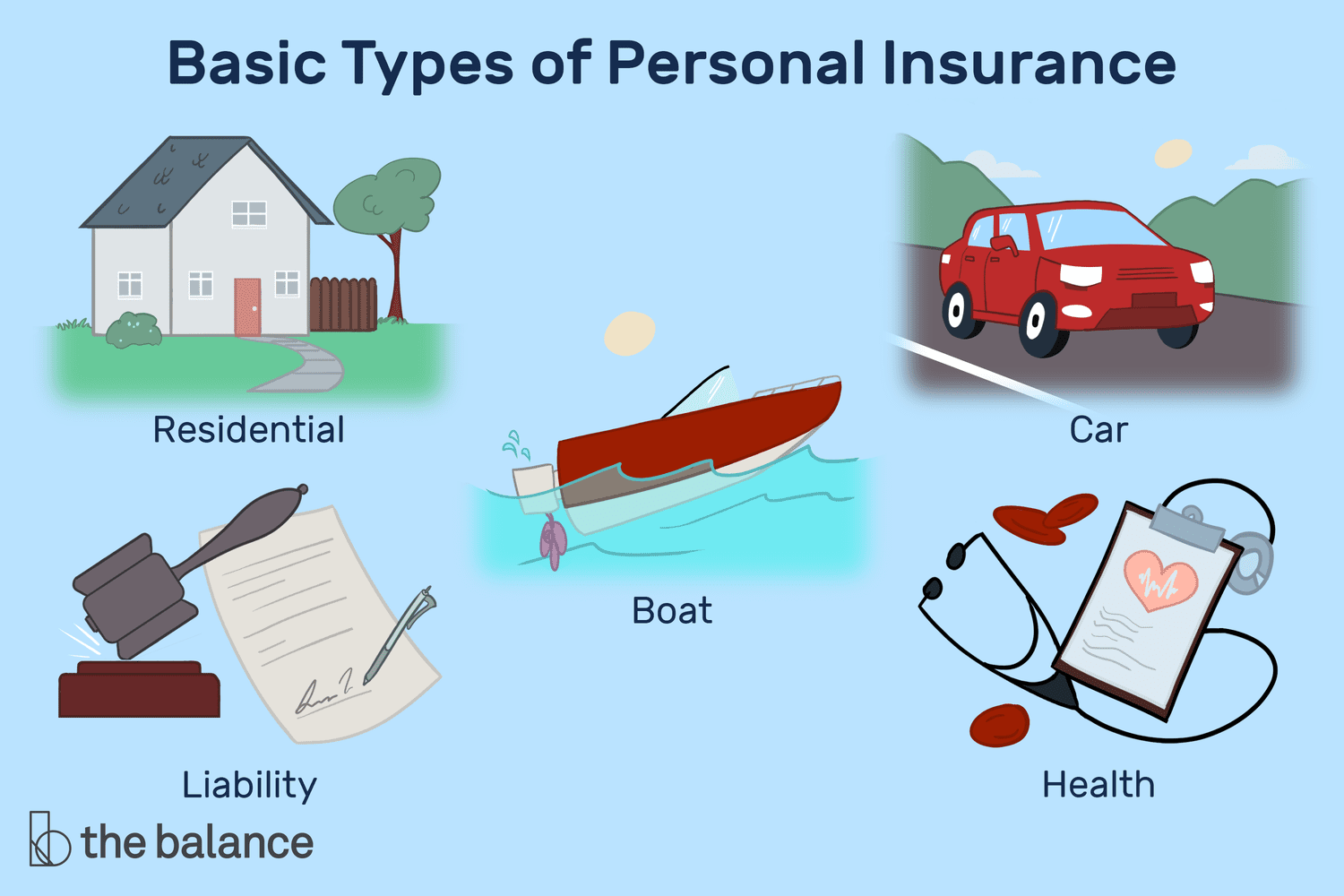

When it comes to personal insurance, there are several common types that individuals can consider to protect themselves and their assets. Let’s explore the various types of personal insurance and the coverage they provide.

Health Insurance, Personal insurance meaning

Health insurance is designed to cover medical expenses and treatments. It helps individuals pay for healthcare services such as doctor visits, hospital stays, prescription medications, and preventive care. Health insurance can be obtained through an employer, government programs, or private insurance companies.

Life Insurance

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. It can help cover funeral expenses, outstanding debts, mortgage payments, and provide income replacement for dependents. There are different types of life insurance, including term life and whole life policies.

Auto Insurance

Auto insurance is mandatory in most states and provides coverage for damages and injuries resulting from car accidents. It typically includes liability coverage (for injuries and property damage to others), collision coverage (for damage to your vehicle), and comprehensive coverage (for non-collision incidents like theft or vandalism).

Home Insurance

Home insurance protects your home and belongings from damages caused by covered perils such as fire, theft, vandalism, and natural disasters. It typically includes dwelling coverage (for the structure of the home), personal property coverage (for belongings), liability coverage (for accidents on your property), and additional living expenses coverage (for temporary housing).

Factors to Consider When Choosing Personal Insurance

When selecting personal insurance policies, there are several key factors that individuals should take into consideration to ensure they have the right coverage for their needs. Personal circumstances such as age, health, and location can greatly impact the type and amount of insurance required. Here are some tips for evaluating coverage options and choosing the right personal insurance:

1. Assess Your Needs

- Consider your current financial situation, including income and expenses.

- Evaluate your assets and liabilities to determine the level of coverage required.

- Take into account any dependents or family members who rely on your income.

2. Understand Different Types of Insurance

- Research and compare various types of personal insurance policies, such as life insurance, health insurance, and disability insurance.

- Understand the coverage, benefits, and limitations of each type of insurance to make an informed decision.

- Consult with an insurance agent or financial advisor for guidance on the best options for your specific needs.

3. Consider Your Health and Lifestyle

- Your health condition and lifestyle choices can impact the cost and coverage of insurance policies.

- Provide accurate information about your health and habits when applying for insurance to ensure you get the right coverage.

- Consider factors such as smoking, alcohol consumption, and participation in risky activities that may affect your premiums.

4. Compare Quotes and Coverage Options

- Obtain quotes from multiple insurance providers to compare premiums, deductibles, and coverage options.

- Review the details of each policy carefully to understand what is included and excluded from coverage.

- Choose a policy that offers the best value for your needs and budget.

Process of Obtaining Personal Insurance: Personal Insurance Meaning

When it comes to obtaining personal insurance, there are specific steps that individuals need to follow to ensure they are adequately covered in case of unforeseen events. Insurance agents or brokers play a crucial role in guiding individuals through this process, helping them understand their options and choose the most suitable insurance policies. It is also essential for individuals to carefully review and understand the terms and conditions of their chosen policy to avoid any misunderstandings in the future.

Steps Involved in Applying for Personal Insurance

- Research Different Insurance Companies: Begin by researching and comparing various insurance companies to find the one that offers the best coverage options for your needs.

- Consult with an Insurance Agent or Broker: Reach out to an insurance agent or broker who can provide expert advice and guidance on the different types of personal insurance available.

- Choose the Right Policy: Work with your insurance agent or broker to select a policy that aligns with your specific requirements, taking into consideration factors such as coverage limits, deductibles, and premiums.

- Complete the Application: Fill out the necessary application forms accurately and provide any required documentation to the insurance company.

- Undergo Underwriting: The insurance company will assess your application, possibly requiring additional information or medical examinations to determine your eligibility and premium rates.

- Review and Sign the Policy: Once your application is approved, carefully review the policy terms and conditions, seeking clarification from your agent or broker on any aspects you do not understand before signing the policy.

Role of Insurance Agents or Brokers

- Provide Expert Advice: Insurance agents or brokers offer guidance on the various insurance options available, helping individuals make informed decisions based on their unique needs.

- Assist in Policy Selection: Agents and brokers assist individuals in selecting the most appropriate policy by explaining coverage details, exclusions, and premium costs.

- Negotiate with Insurance Companies: Brokers can negotiate with insurance companies on behalf of their clients to secure the best coverage at competitive rates.

Importance of Reviewing Policy Terms and Conditions

- Understanding Coverage: Reviewing policy terms ensures that individuals understand what is covered by their insurance and any limitations or exclusions that may apply.

- Clarity on Premiums and Deductibles: Knowing the premium costs and deductible amounts helps individuals budget effectively and avoid surprises when filing a claim.

- Avoiding Misunderstandings: Thoroughly reviewing policy terms helps prevent misunderstandings or disputes with the insurance company in the event of a claim.

Closing Notes

In conclusion, personal insurance plays a crucial role in ensuring one’s financial stability by mitigating risks and uncertainties. By choosing the right coverage based on individual needs, one can secure a safer and more certain future.