Humana Health Insurance Medicare Supplement offers a wide range of coverage options and benefits for individuals seeking additional healthcare support. Dive into this detailed overview to understand how this plan can benefit you.

Overview of Humana Health Insurance Medicare Supplement

Humana Health Insurance Medicare Supplement offers additional coverage to fill the gaps left by Original Medicare. It provides a range of benefits to help policyholders manage their healthcare costs effectively.

Key Features and Benefits of Humana Health Insurance Medicare Supplement

- Comprehensive Coverage: Humana Health Insurance Medicare Supplement offers a wide range of coverage options, including deductibles, copayments, and coinsurance.

- Freedom to Choose Providers: Policyholders have the flexibility to choose their healthcare providers without network restrictions.

- Predictable Costs: With fixed monthly premiums, policyholders can budget their healthcare expenses more effectively.

- No Referral Required: Policyholders do not need a referral to see a specialist, giving them more control over their healthcare decisions.

- Travel Coverage: Some plans may offer coverage for emergency healthcare services while traveling outside the United States.

How Humana Health Insurance Medicare Supplement Works

Humana Health Insurance Medicare Supplement works as a secondary insurance to Original Medicare. Once enrolled, policyholders can visit any healthcare provider that accepts Medicare, and Humana will pay its share of the covered healthcare costs after Medicare pays its portion.

Coverage Options

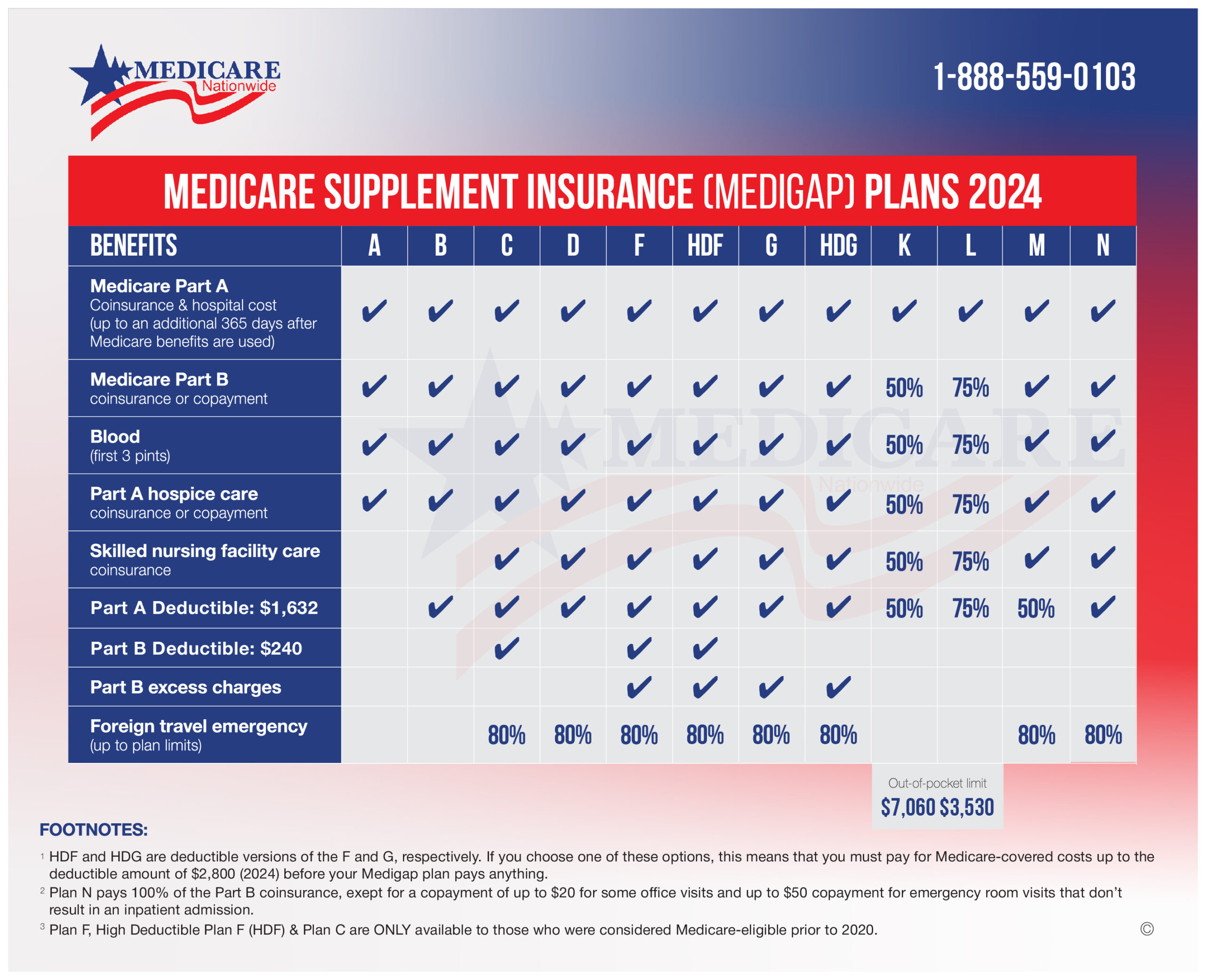

When it comes to coverage options under Humana Health Insurance Medicare Supplement, there are several plans available to meet the needs of different individuals. These plans are designed to help cover expenses that Original Medicare may not fully pay for, such as copayments, coinsurance, and deductibles.

Different Coverage Options

- Plan A: This basic plan covers essential benefits like Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

- Plan B: In addition to the benefits of Plan A, this plan covers Medicare Part A deductible and skilled nursing facility care coinsurance.

- Plan F: One of the most comprehensive plans, covering all deductibles, copayments, and coinsurance under Original Medicare, as well as excess charges.

- Plan G: Similar to Plan F but does not cover the Medicare Part B deductible.

- Plan N: A cost-sharing plan with lower premiums, covering Medicare Part A coinsurance, hospital costs, and Part B coinsurance or copayment.

Comparison with Other Plans

- Compared to other similar plans in the market, Humana Health Insurance Medicare Supplement offers a wide range of coverage options to cater to different healthcare needs.

- Each plan has its own set of benefits and cost-sharing features, allowing individuals to choose a plan that best suits their budget and healthcare requirements.

Additional Benefits and Perks

- Some additional benefits included in the coverage of Humana Health Insurance Medicare Supplement plans may include coverage for foreign travel emergencies, fitness programs, and vision and dental benefits.

- These extra perks can provide added value and convenience to policyholders, enhancing their overall healthcare experience.

Eligibility and Enrollment

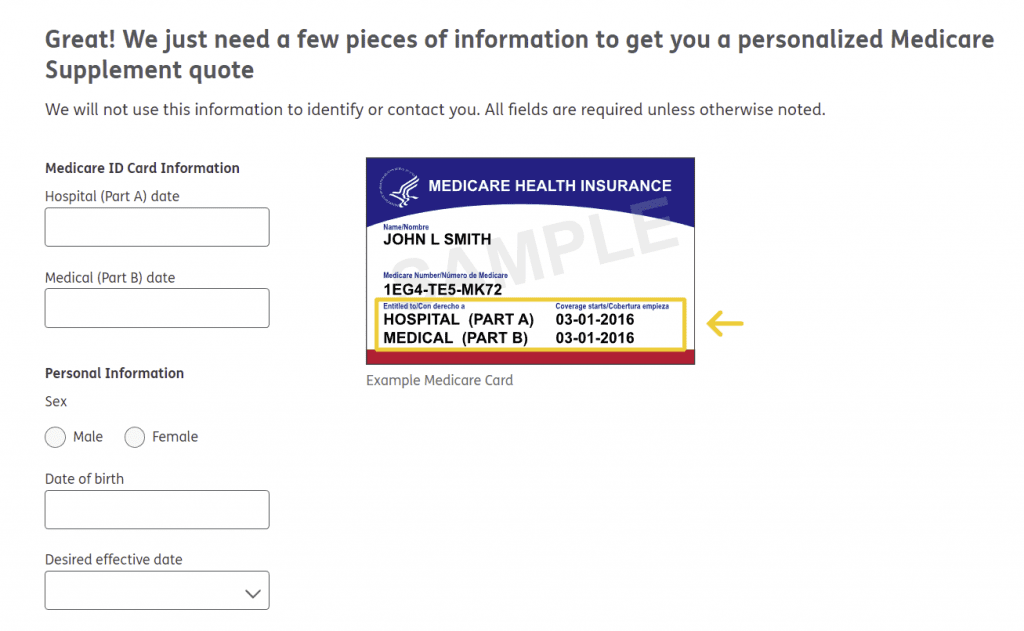

To be eligible for Humana Health Insurance Medicare Supplement, individuals must already be enrolled in Medicare Part A and Part B. This supplemental insurance is designed to help cover costs not included in original Medicare.

Eligibility Requirements

- Individuals must be enrolled in Medicare Part A and Part B.

- Must reside in the service area where the plan is offered.

Enrollment Process

- Enrollment can typically be done during the Initial Enrollment Period (IEP) when you first become eligible for Medicare.

- There are also Special Enrollment Periods (SEPs) for specific circumstances, such as losing employer coverage or moving out of the plan’s service area.

Enrollment Deadlines and Special Considerations

- Initial Enrollment Period (IEP) for Medicare is usually a 7-month window starting 3 months before you turn 65.

- It is important to enroll in a Medicare Supplement plan within the first 6 months of turning 65 to avoid any penalties.

- For those missing the Initial Enrollment Period, there is an Annual Enrollment Period (AEP) from October 15 to December 7 each year.

Cost and Pricing

When it comes to Humana Health Insurance Medicare Supplement, understanding the cost structure is essential for making an informed decision. Let’s break down the pricing of this plan, compare it with competitors, and explore the factors that influence its pricing.

Cost Breakdown

- Monthly Premiums: The cost of the Humana Medicare Supplement plan varies depending on the coverage level you choose.

- Out-of-Pocket Expenses: You may have to pay deductibles, copayments, and coinsurance for certain services.

- Medicare Part B Premium: In addition to the plan premium, you still need to pay your Medicare Part B premium to maintain coverage.

Comparison with Competitors

- Humana’s pricing for Medicare Supplement plans is competitive compared to other insurance providers in the market.

- While pricing can vary based on factors like age, location, and plan choice, Humana offers a range of options to suit different budgets.

Factors Affecting Pricing, Humana health insurance medicare supplement

- Age: Younger beneficiaries may pay lower premiums compared to older individuals.

- Location: Pricing may differ based on where you live, as healthcare costs can vary by region.

- Tobacco Use: Some insurers may charge higher premiums for smokers due to increased health risks.

- Plan Type: The level of coverage and benefits you choose will impact the overall pricing of the Medicare Supplement plan.

Network Coverage

When it comes to network coverage, Humana Health Insurance Medicare Supplement offers a wide range of healthcare providers and facilities to choose from.

Healthcare Providers and Facilities

- Humana Health Insurance Medicare Supplement covers a network of doctors, specialists, hospitals, and other healthcare providers across the country.

- Members have the flexibility to choose their preferred healthcare providers within the network for their medical needs.

- Providers in the network have agreed to accept the insurance plan’s payment terms, which can result in lower out-of-pocket costs for members.

Out-of-Network Coverage

- In some cases, members may need to seek care from healthcare providers outside of the network.

- Humana Health Insurance Medicare Supplement may offer out-of-network coverage options, but members may have higher out-of-pocket costs when receiving care from providers outside the network.

- It’s important for members to understand the out-of-network coverage options available and the associated costs before seeking care from providers outside the network.

Customer Reviews and Satisfaction

Customer feedback and satisfaction ratings play a crucial role in evaluating the quality of service provided by Humana Health Insurance Medicare Supplement. Let’s delve into an overview of customer reviews, common feedback or complaints, and how customer satisfaction is measured and reported in the industry.

Overview of Customer Reviews

- Many customers have praised Humana Health Insurance Medicare Supplement for its comprehensive coverage options and affordable pricing.

- Some customers have expressed satisfaction with the ease of enrollment and the responsive customer service provided by Humana.

- Positive reviews often highlight the network coverage and the range of healthcare providers available to choose from.

Common Feedback or Complaints

- Some customers have reported issues with claim processing and reimbursement delays.

- A few customers have noted challenges with accessing certain healthcare providers within the network.

- There have been occasional complaints about the clarity of coverage details and communication from Humana regarding policy updates.

Measurement of Customer Satisfaction

- Customer satisfaction is typically measured through surveys, feedback forms, and online reviews submitted by policyholders.

- Industry benchmarks and standards are used to evaluate customer satisfaction levels and compare them against competitors in the market.

- Reports on customer satisfaction are often published by independent agencies to provide transparency and insights into the performance of insurance providers.

Last Word: Humana Health Insurance Medicare Supplement

In conclusion, Humana Health Insurance Medicare Supplement stands out for its comprehensive coverage, flexible network options, and positive customer satisfaction ratings. Make an informed decision about your healthcare needs with this valuable insurance plan.