Delving into commute or pleasure car insurance reddit, this introduction immerses readers in a unique and compelling narrative. Exploring the nuances between commute and pleasure car insurance, this topic sheds light on how insurance companies classify usage and how it impacts insurance premiums.

Understanding Commute vs. Pleasure Car Insurance

When it comes to car insurance, understanding the difference between commute and pleasure car insurance is crucial. Let’s delve into how insurance companies classify these types of usage and how they can affect insurance premiums.

Definition of Commute and Pleasure Car Insurance

- Commute Car Insurance: This type of insurance is for vehicles used for daily commuting to and from work or school. It typically involves more time on the road during peak traffic hours.

- Pleasure Car Insurance: Pleasure car insurance is for vehicles used for leisure activities like weekend drives, errands, or occasional trips. The vehicle is not used for daily commuting.

Classification by Insurance Companies

- Insurance companies classify the usage of a vehicle based on the information provided by the policyholder. They will ask about the primary use of the vehicle to determine the appropriate coverage.

- Policyholders are required to be honest about the primary use of the vehicle to avoid potential issues with claims in the future.

Impact on Insurance Premiums

- Commute car insurance typically carries higher premiums due to the increased risk associated with daily commuting, such as traffic congestion and a higher probability of accidents.

- Pleasure car insurance usually has lower premiums since the vehicle is not on the road as frequently and is less likely to be involved in accidents.

- Providing accurate information about the usage of your vehicle can help insurance companies determine the appropriate premium and coverage for your specific needs.

Factors Influencing Insurance Premiums: Commute Or Pleasure Car Insurance Reddit

When it comes to car insurance premiums, there are several key factors that can influence the cost of coverage. Whether you have commute or pleasure car insurance, understanding these factors can help you make informed decisions and potentially save money on your policy.

Driving Habits and Insurance Rates

Driving habits play a significant role in determining insurance rates for both commute and pleasure car insurance. Insurers consider factors such as how often you drive, the distance you typically travel, and your driving history when calculating premiums. Those who have longer commutes or drive more frequently may face higher insurance rates due to increased exposure to potential risks on the road.

Impact of Mileage, Location, and Vehicle Type

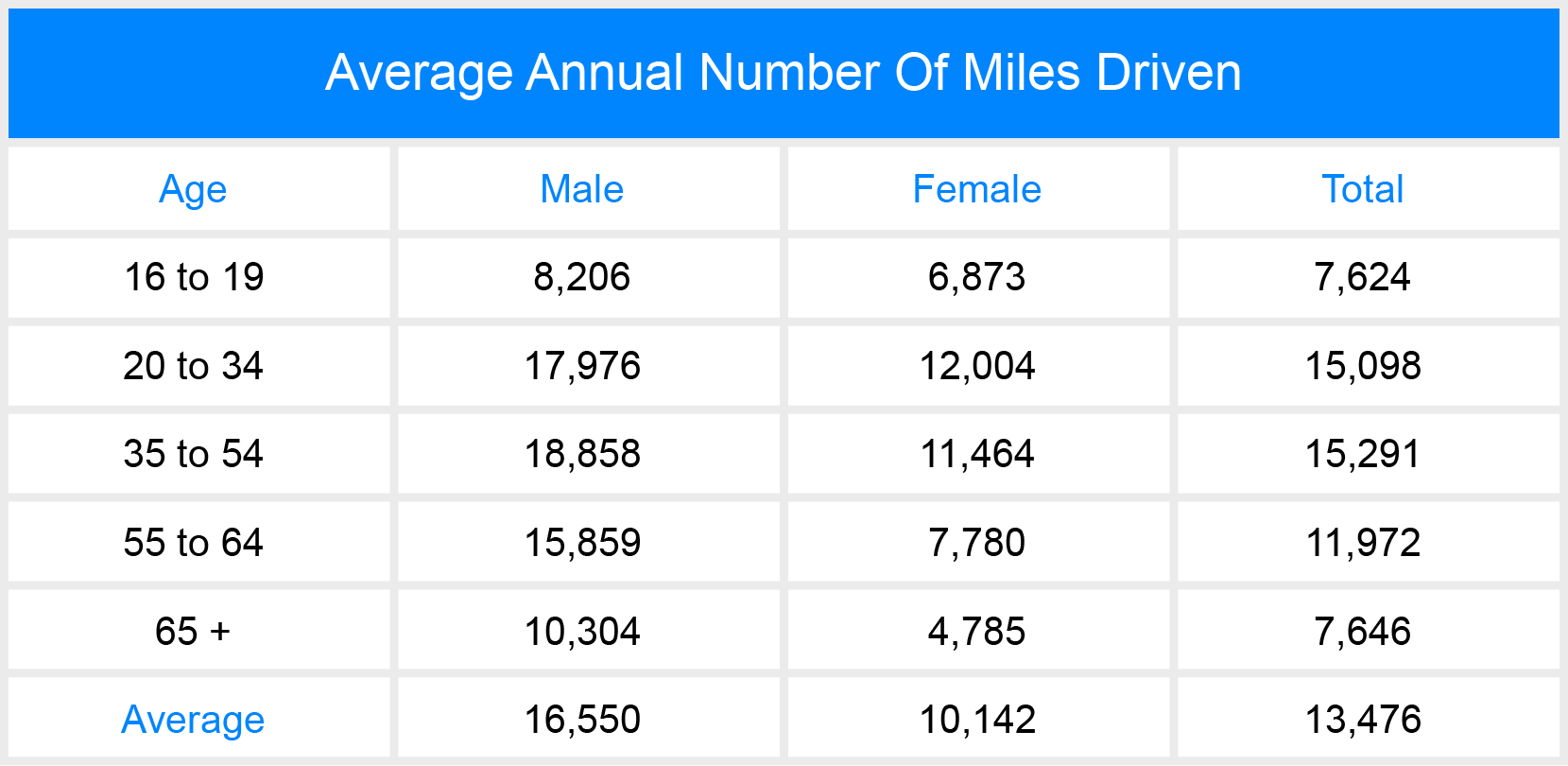

– Mileage: The number of miles you drive annually can impact your insurance premiums. Those who drive fewer miles, such as individuals with pleasure car insurance, may qualify for lower rates compared to frequent commuters.

– Location: Where you live and park your car can also affect insurance premiums. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas.

– Vehicle Type: The make, model, and age of your vehicle can influence insurance rates. Luxury cars or sports cars may have higher premiums due to repair costs, while older vehicles with safety features could result in lower rates.

Coverage Options for Commute and Pleasure Car Insurance

When it comes to car insurance, coverage options can vary depending on whether you are using your vehicle for commuting or pleasure. It’s important to understand the differences in coverage options for each type of usage to ensure you have the appropriate protection in place.

Common Coverage Options

- Liability Coverage: This covers bodily injury and property damage that you may cause to others in an accident.

- Collision Coverage: This pays for damage to your car in the event of a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your car from non-collision incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are in an accident with a driver who has insufficient or no insurance.

Specific Coverage Requirements

- Commute Car Insurance: If you use your car for commuting to work or school, you may need higher liability limits to protect you in case of an accident during rush hour traffic.

- Pleasure Car Insurance: If you only use your car for personal errands or recreational activities, you may not need as much coverage since you are not driving as frequently.

Differences in Coverage Options

- Commute Car Insurance may have higher premiums due to the increased risk of accidents during peak travel times.

- Pleasure Car Insurance may offer lower premiums since the vehicle is not being used for daily commuting.

- Some insurance companies may offer specific discounts or benefits for each type of usage, so it’s important to inquire about these when selecting your coverage options.

Tips for Saving on Commute or Pleasure Car Insurance

When it comes to saving money on your commute or pleasure car insurance, there are several strategies you can implement to lower your premiums and get the best possible coverage. By taking some proactive steps and being aware of key factors that influence insurance costs, you can potentially save a significant amount of money in the long run.

Consider Mileage Limits

Setting mileage limits on your policy can help reduce your insurance costs for both commute and pleasure car usage. By driving less, you are considered less of a risk by insurance companies, which can lead to lower premiums. Be sure to accurately estimate your annual mileage to ensure you are not overpaying for coverage you do not need.

Maintain a Clean Driving Record, Commute or pleasure car insurance reddit

One of the most effective ways to save on car insurance is to maintain a clean driving record. Avoiding accidents and traffic violations can help keep your premiums low, as insurance companies typically offer discounts to safe drivers. By being a responsible driver, you can save money on both commute and pleasure car insurance.

Bundle Policies for Discounts

Another way to save on car insurance is to bundle multiple policies, such as car and home insurance, with the same provider. Many insurance companies offer discounts for bundling, which can result in significant savings on your premiums. By consolidating your insurance policies, you can lower your overall costs for both commute and pleasure car insurance.

Shop Around and Compare Quotes

One of the most important steps in saving on car insurance is to shop around and compare quotes from different insurance providers. Rates can vary significantly between companies, so it is essential to explore your options and choose the policy that offers the best coverage at the most competitive price. By comparing quotes, you can ensure you are getting the most value for your money and potentially save on both commute and pleasure car insurance.

Conclusion

In conclusion, understanding the distinctions between commute and pleasure car insurance is crucial for making informed decisions. By grasping the factors that influence premiums, coverage options, and money-saving tips, individuals can navigate the complexities of car insurance with confidence and clarity.