Humana Medicare Supplement Insurance Plans offer extensive coverage and a range of benefits, making them a top choice for many individuals seeking reliable healthcare options. Dive into the details of these plans to discover why they stand out in the market.

Overview of Humana Medicare Supplement Insurance Plans

Humana offers Medicare Supplement Insurance Plans that provide additional coverage to fill the gaps left by Original Medicare. These plans help pay for costs such as copayments, coinsurance, and deductibles that Medicare does not cover.

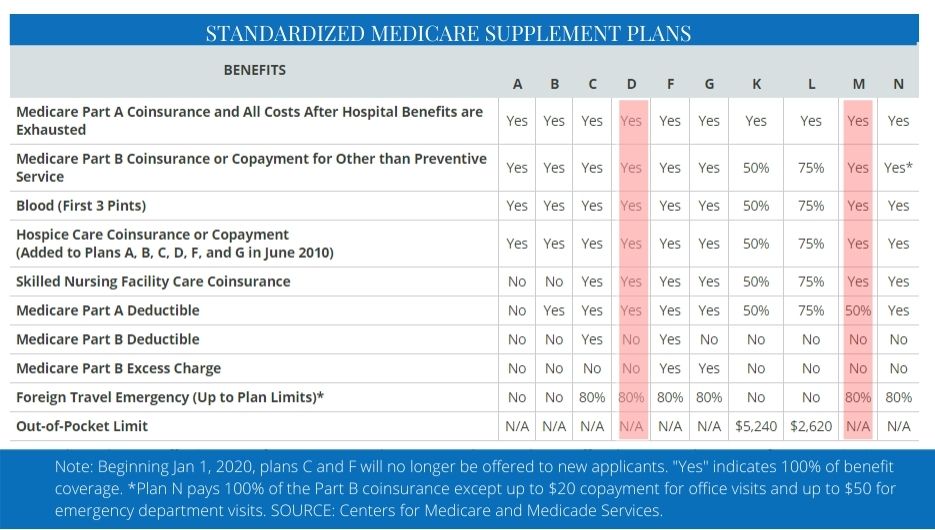

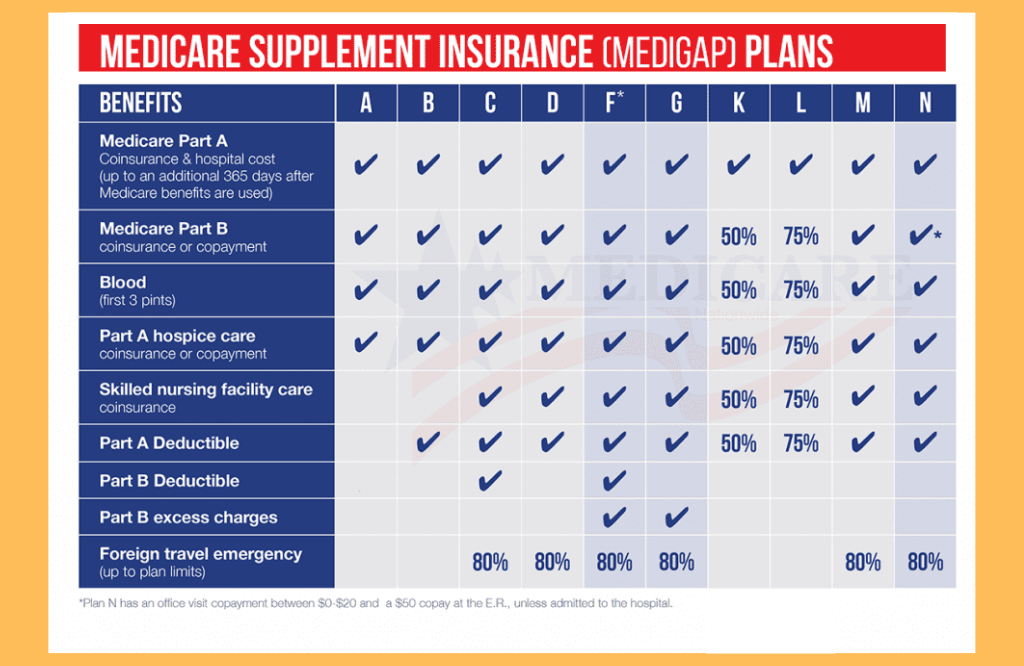

Coverage Provided by Humana Medicare Supplement Insurance Plans

- Coverage for Medicare Part A coinsurance and hospital costs

- Coverage for Medicare Part B coinsurance or copayment

- Coverage for skilled nursing facility care coinsurance

- Coverage for the first three pints of blood needed for a medical procedure

- Coverage for hospice care coinsurance or copayment

Benefits of Choosing Humana Medicare Supplement Insurance Plans

- Flexibility to see any doctor or specialist that accepts Medicare

- Predictable out-of-pocket costs for medical expenses

- No referrals needed to see a specialist

- Coverage for medical emergencies when traveling outside the U.S.

- Renewable coverage guaranteed as long as premiums are paid

Comparison with other Medicare Supplement Insurance providers

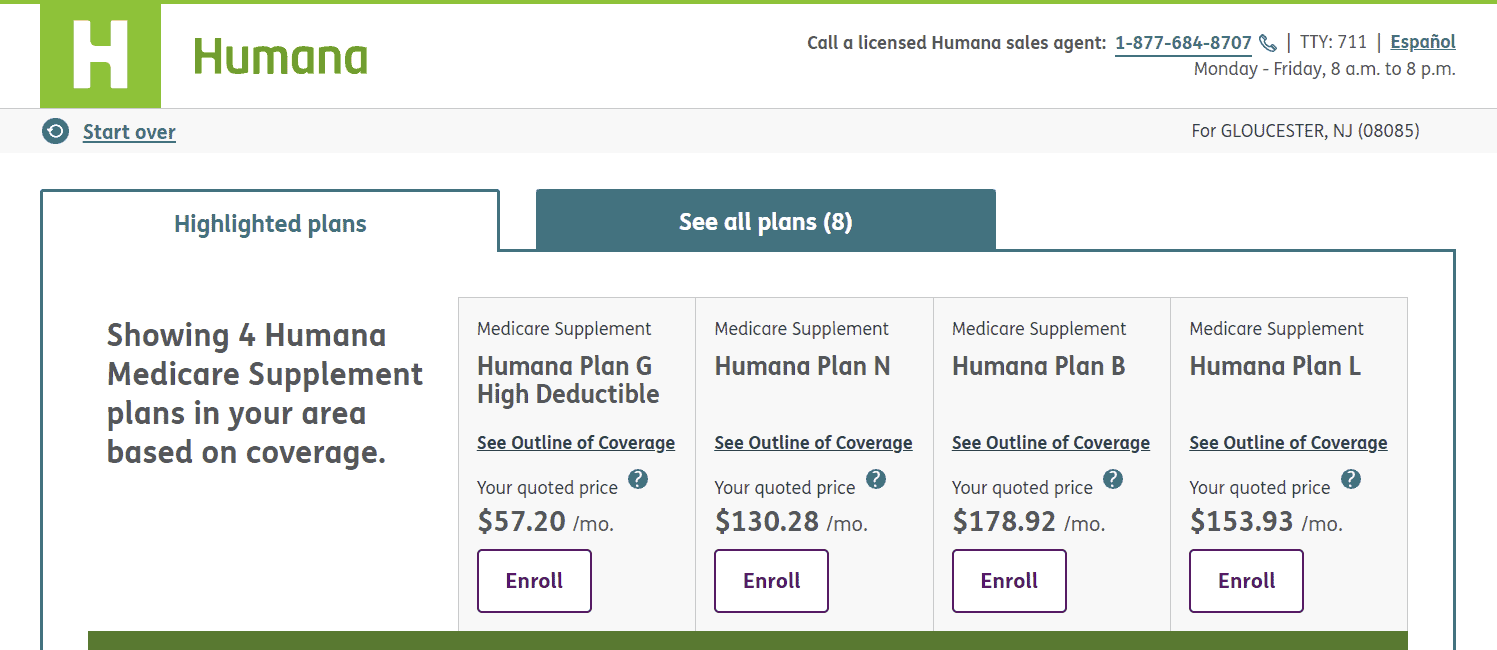

When comparing Humana Medicare Supplement Insurance Plans with other providers, it is essential to consider factors such as premium costs, coverage options, and customer satisfaction ratings. Humana offers a range of plans to meet different needs and budgets, along with additional wellness programs and resources to support their members.

Different Types of Humana Medicare Supplement Insurance Plans

When it comes to Humana Medicare Supplement Insurance Plans, there are several types available to meet different needs and preferences. Each plan offers varying levels of coverage and benefits, so it’s essential to understand the differences to choose the right one for you.

Types of Plans

- Plan A: This plan offers basic coverage, including Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

- Plan B: In addition to the benefits of Plan A, Plan B also covers Medicare Part A deductible and skilled nursing facility care coinsurance.

- Plan F: Plan F is the most comprehensive plan, covering all gaps in Medicare Part A and B, including deductibles, coinsurance, and excess charges.

Coverage Differences

Each plan varies in terms of coverage and cost-sharing responsibilities. Plan F, for example, provides more extensive coverage but may come with higher premiums compared to Plan A or Plan B. It’s essential to evaluate your healthcare needs and budget to determine which plan offers the right balance of coverage and cost for you.

Beneficial Situations

- Plan A: Plan A may be suitable for individuals who want basic coverage at a lower premium, especially if they don’t anticipate frequent medical expenses.

- Plan B: Plan B could be beneficial for those who want coverage for Medicare Part A deductible and skilled nursing facility care, in addition to the basic benefits of Plan A.

- Plan F: Plan F might be a good option for individuals who prefer comprehensive coverage without worrying about out-of-pocket costs, making it suitable for those with frequent medical needs.

Eligibility and Enrollment Process

To enroll in Humana Medicare Supplement Insurance Plans, individuals must meet certain eligibility criteria. Below is an overview of the eligibility requirements and the enrollment process.

Eligibility Criteria

- Individuals must be enrolled in Medicare Part A and Part B.

- Applicants must be aged 65 or older, although some states may offer plans for those under 65 with certain disabilities.

- People looking to enroll in a Humana Medicare Supplement plan should not have end-stage renal disease (ESRD).

Enrollment Process, Humana medicare supplement insurance plans

Once eligibility criteria are met, individuals can enroll in a Humana Medicare Supplement Insurance Plan during their Initial Enrollment Period (IEP). This is a 7-month period that begins three months before the individual turns 65, includes their birthday month, and ends three months after.

There are also Special Enrollment Periods (SEPs) that allow individuals to enroll outside of the IEP under special circumstances, such as losing employer coverage or relocating.

If someone is already enrolled in a Medicare Supplement plan with another provider and wishes to switch to a Humana plan, they can do so during the Annual Enrollment Period (AEP) from October 15th to December 7th each year. It’s important to note that medical underwriting may be required depending on the timing of the switch.

Cost and Pricing Information

When it comes to Humana Medicare Supplement Insurance Plans, understanding the cost and pricing structure is crucial for making informed decisions about your healthcare coverage. Here, we will delve into how the pricing works, any additional costs or fees you may encounter, and tips on saving money on premiums or out-of-pocket expenses.

Pricing Structure for Humana Medicare Supplement Insurance Plans

Humana’s Medicare Supplement Insurance Plans typically use one of three pricing methods: community-rated, issue-age-rated, or attained-age-rated. Community-rated plans have the same premium for everyone in the same area, regardless of age. Issue-age-rated plans base premiums on your age when you first enroll, while attained-age-rated plans adjust premiums as you age.

Additional Costs or Fees

Aside from the monthly premium, you may encounter other costs such as deductibles, copayments, and coinsurance depending on the specific plan you choose. It’s essential to review the plan details carefully to understand all potential out-of-pocket expenses.

Tips for Saving Money

– Consider enrolling during your Medigap Open Enrollment Period to avoid higher premiums due to health conditions.

– Compare different Humana Medicare Supplement Insurance Plans to find one that meets your needs at the best price.

– Opt for a plan with higher out-of-pocket costs in exchange for lower premiums if you are generally healthy and don’t anticipate frequent medical visits.

Customer Reviews and Satisfaction

When it comes to customer reviews and satisfaction with Humana Medicare Supplement Insurance Plans, it is important to consider the feedback from actual users of the plans. Here, we will delve into the overall satisfaction levels of customers with Humana’s services and highlight any common praises or criticisms regarding their plans.

Overall Customer Satisfaction

- Many customers have expressed satisfaction with the comprehensive coverage provided by Humana Medicare Supplement Insurance Plans.

- Users appreciate the flexibility and peace of mind that comes with having a plan that covers gaps in Medicare.

- Humana’s customer service is often praised for being responsive and helpful in addressing any inquiries or concerns.

Common Praises and Criticisms

- Some users have commended the ease of enrollment and the clarity of information provided by Humana regarding their plans.

- On the other hand, some customers have criticized the pricing of Humana’s Medicare Supplement Insurance Plans, stating that they can be on the higher end compared to other providers.

- There have been mixed reviews regarding the claim process, with some users experiencing delays while others have found it to be efficient.

Closing Summary

In conclusion, Humana Medicare Supplement Insurance Plans provide a robust solution for those looking for quality healthcare coverage. With a variety of plans to choose from and positive customer feedback, these plans are worth considering for your healthcare needs.