My insurance portal serves as a crucial tool for efficiently managing your insurance policies, offering a seamless user experience with enhanced convenience. Dive into the world of insurance management with the click of a button.

Importance of My Insurance Portal

Having a personalized insurance portal is crucial for efficiently managing your insurance policies. It provides a centralized platform where you can access all your policy details, make payments, file claims, and communicate with your insurance provider.

Features of Insurance Portals

- Policy Details: Easily view and update your policy information, such as coverage limits and beneficiaries.

- Payment Options: Conveniently make premium payments online through secure payment gateways.

- Claims Processing: File and track claims directly through the portal, streamlining the process and reducing paperwork.

- Communication Tools: Receive important updates, alerts, and messages from your insurance company in real-time.

- Document Storage: Safely store and access policy documents, receipts, and correspondence in one place.

By utilizing an insurance portal, users can enjoy enhanced convenience and user experience. It eliminates the need for traditional paper-based communication, reduces processing times, and allows for immediate access to critical information.

Registration and Login Process

When it comes to accessing your insurance portal, the registration and login process plays a crucial role in ensuring security and convenience for users. Let’s explore the steps involved in setting up an account and logging in securely.

Registration Process

- Visit the insurance portal’s website and locate the registration page.

- Fill out the required fields such as your name, contact information, and policy details.

- Create a strong password that includes a mix of letters, numbers, and special characters.

- Agree to the terms and conditions provided by the insurance company.

- Verify your email address or phone number to complete the registration process.

Login Security Measures

- During the registration process, the insurance portal may implement security measures such as captcha verification to prevent bots from creating fake accounts.

- Two-factor authentication (2FA) may be enabled to add an extra layer of security when logging in.

- Regular password updates or password strength requirements can also enhance the security of your account.

Authentication Methods

- Once registered, users can log in using their email address or username along with the password created during registration.

- Some insurance portals may offer biometric authentication options such as fingerprint or facial recognition for added security.

- Security questions or one-time codes sent to registered devices may also be used as authentication methods during login.

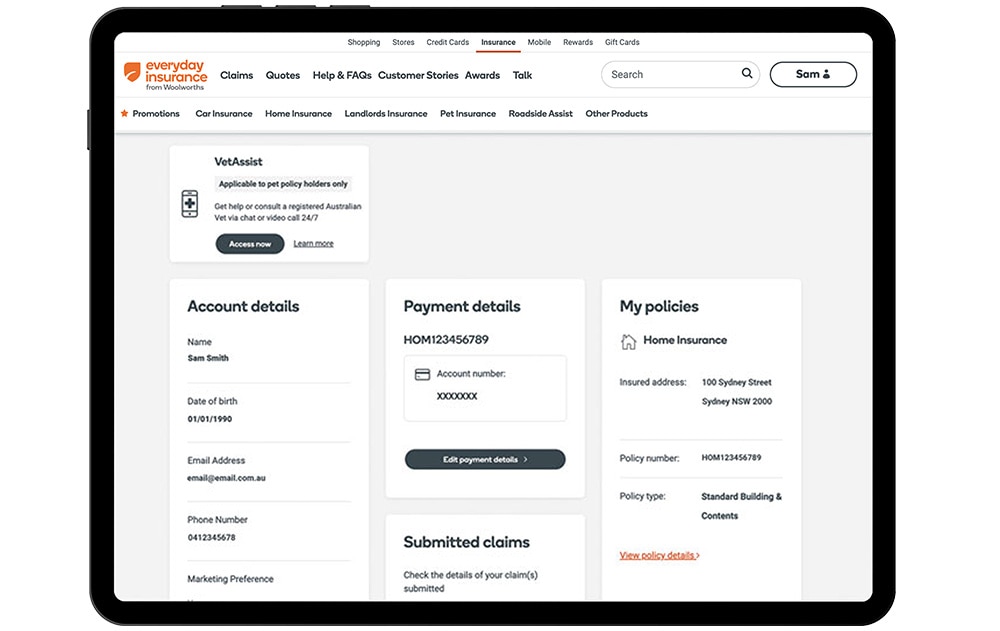

Policy Management: My Insurance Portal

When it comes to managing your insurance policies on our portal, we make it easy for you to access and make changes to your existing policies with convenience and efficiency.

Viewing Existing Policies

- Once logged in, navigate to the “My Policies” section on the portal.

- You will be able to see a list of all your current insurance policies, including details such as coverage, premium amount, and policy term.

- Click on each policy to view additional information and documents related to that specific policy.

Making Changes to Policies

- To make changes to any of your policies, select the policy you wish to modify from the “My Policies” section.

- Look for the option to edit or make changes to the policy details.

- Follow the on-screen prompts to update information such as beneficiaries, coverage amounts, or contact details.

- Make sure to review and confirm the changes before submitting them through the portal.

Organizing and Managing Policies Efficiently

- Consider creating folders or categories within the portal to organize different types of insurance policies (e.g., health, auto, home).

- Use labels or tags to easily identify policies based on specific criteria or renewal dates.

- Regularly review and update your policy information to ensure accuracy and relevance.

- Set up reminders or notifications within the portal for important policy renewal dates or upcoming changes.

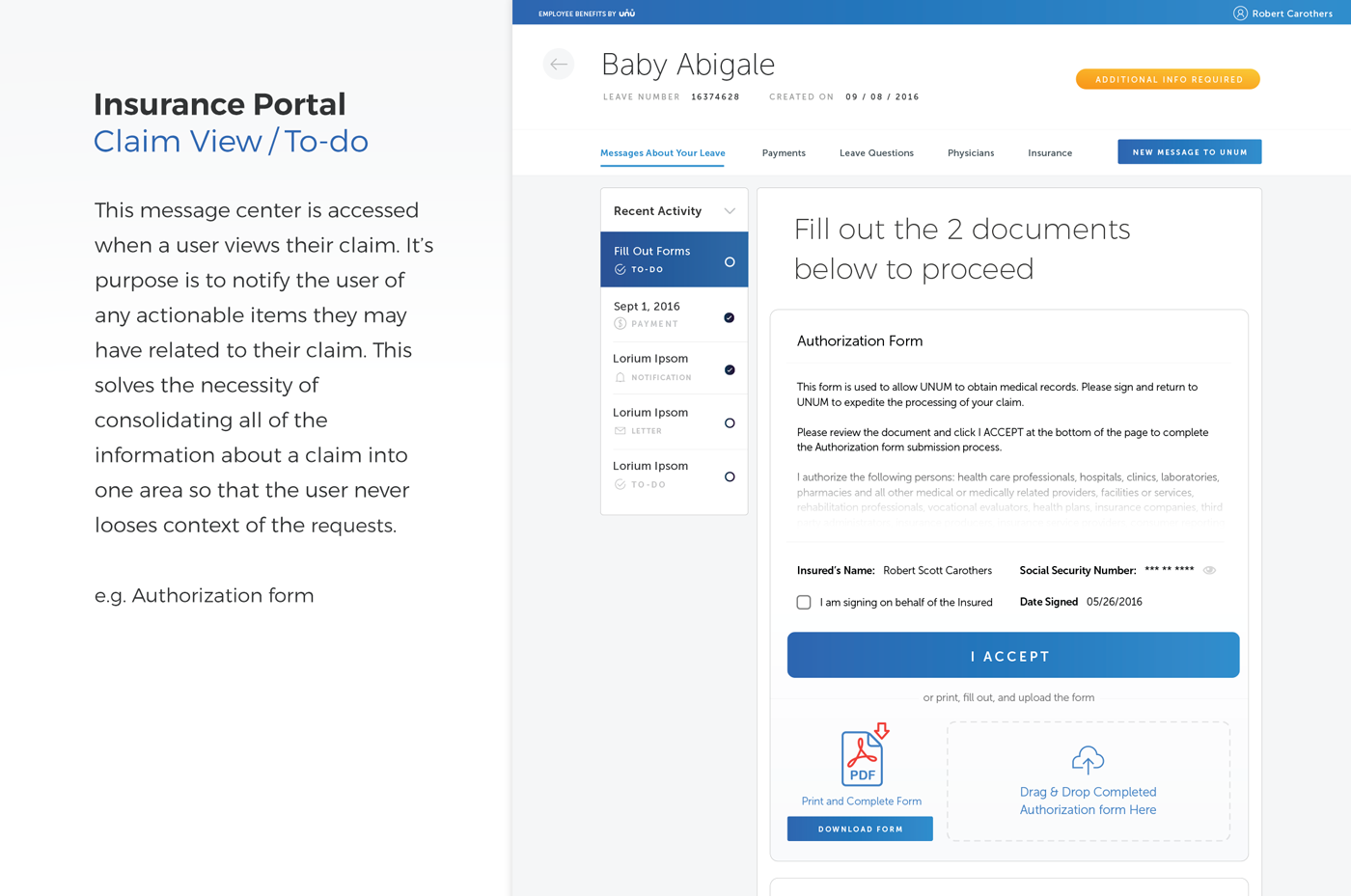

Claims Processing

When it comes to filing insurance claims through our portal, we strive to make the process as seamless and convenient as possible for our users. Below, you will find detailed information on how to file claims, the required documentation for different types of claims, and the communication channels available for tracking claim status.

Filing a Claim

- Log in to your account on the portal.

- Navigate to the claims section and select the type of claim you wish to file (e.g., auto, home, health).

- Fill out the necessary information and provide any supporting documentation required for the claim.

- Submit the claim through the portal for processing.

Required Documentation

Depending on the type of claim you are filing, different documentation may be required. Here is a general overview:

| Claim Type | Documentation Required |

|---|---|

| Auto Insurance | Police report, photos of the accident, repair estimates |

| Home Insurance | Inventory of damaged items, receipts for repairs |

| Health Insurance | Medical bills, doctor’s diagnosis, treatment plan |

Tracking Claim Status

- Once you have submitted your claim, you can track its status through the portal.

- Receive notifications on any updates or additional information required for the claim.

- Communicate with our claims team through the portal for any inquiries or assistance needed.

- View the progress of your claim and any decisions made by the insurance company.

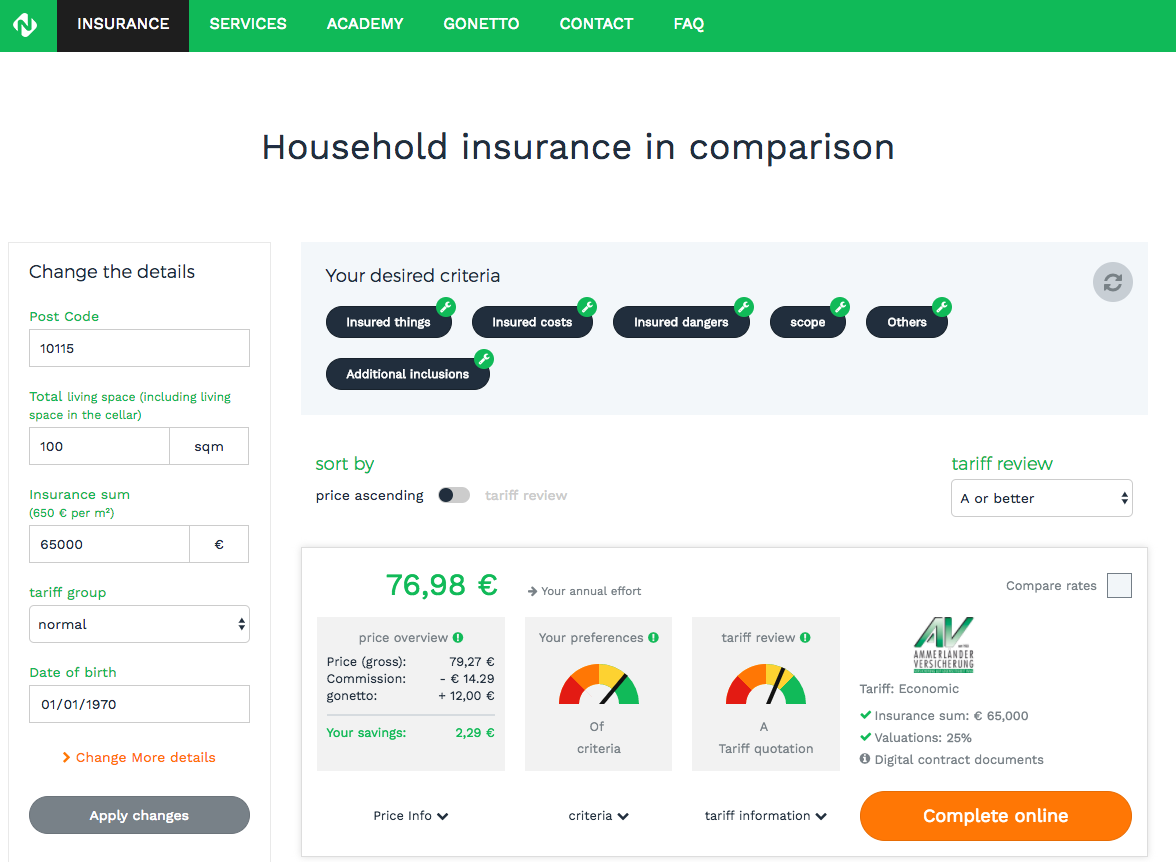

Premium Payments

When it comes to managing your insurance policy, making premium payments is a crucial aspect that ensures your coverage remains active. Through the insurance portal, you have convenient options available to easily pay your premiums and maintain your policy without any hassle.

Payment Options

- Debit or Credit Card: You can securely enter your card details on the portal to make a one-time payment.

- Bank Transfer: Set up your bank account details on the portal for easy transfer of premium amounts.

- Online Wallets: Some insurance portals offer the option to pay through popular online wallets for added convenience.

Security Measures

- Encryption: All online payment transactions are encrypted to protect your personal and financial information.

- Two-factor Authentication: Some portals may require an additional verification step to ensure secure payments.

- Regular Security Updates: The portal regularly updates security protocols to safeguard against any potential threats.

Automatic Payments, My insurance portal

Setting up automatic payments for your premiums can ensure that you never miss a payment deadline. By linking your preferred payment method to the portal, you can schedule recurring payments on a specified date each month. This not only saves you time and effort but also eliminates the risk of policy lapse due to missed payments.

Concluding Remarks

In conclusion, my insurance portal revolutionizes the way you interact with your insurance policies, providing a centralized platform for easy access and efficient management. Explore the possibilities today and take control of your insurance journey.